The Four Corners Pledge

The Colorado Pledge launched in 2020 to make a CC education affordable for Colorado students.

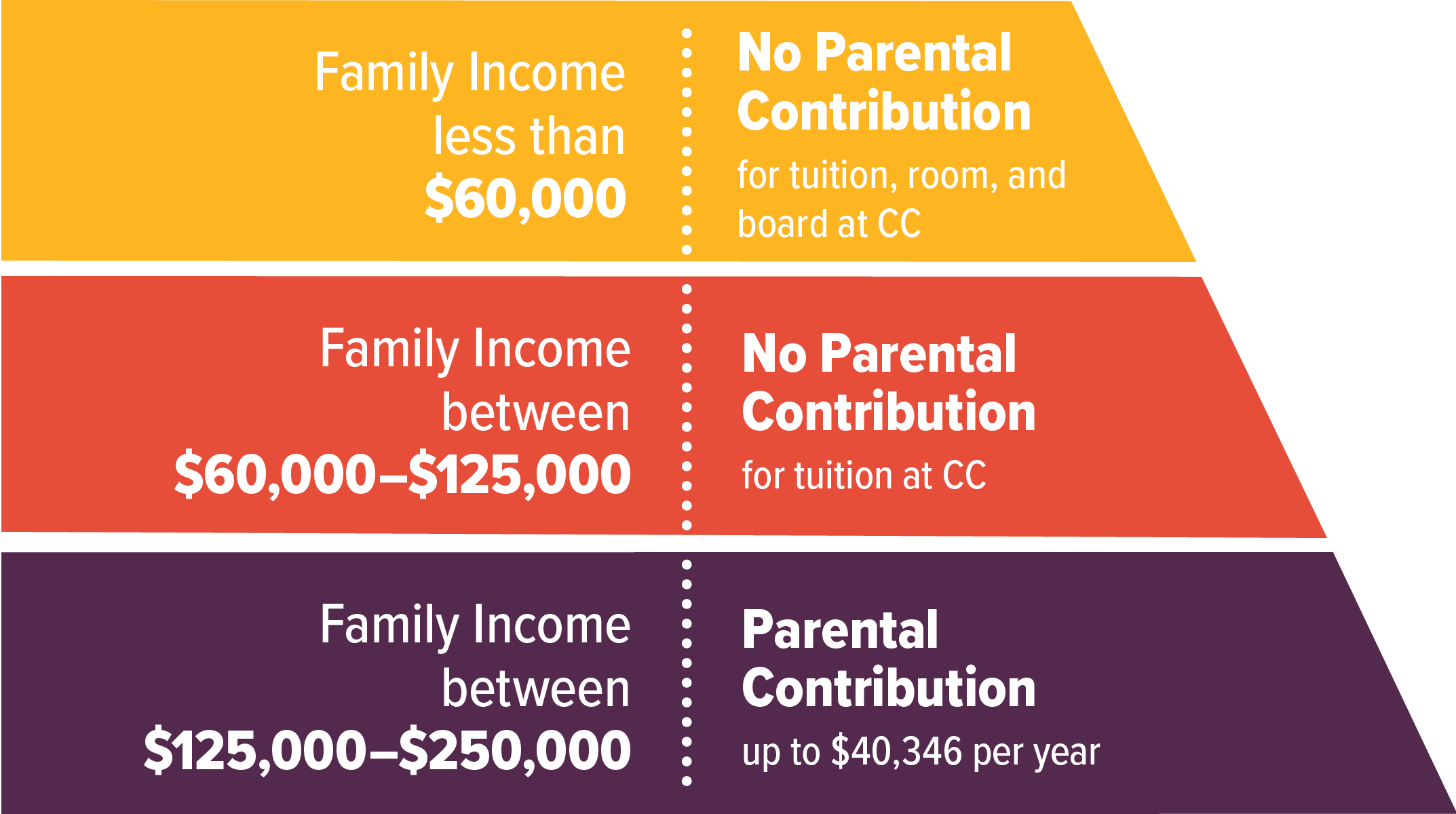

Now, CC is excited to expand this program to families in the "Four Corners" region of Arizona, New Mexico, and Utah. If your family's adjusted gross income (AGI) is under $250,000 a year and your family holds assets typical for your income, the price of a CC education is designed to approximate what you'd pay at our region's top public universities. See our Frequently Asked Questions for more details.

Four Corners residents can use CC’s Net Price Calculator to estimate their aid, including the Four Corners Pledge. For families with more complex financial situations - such as business or farm ownership, divorced or separated parents, or assets that are high relative to income - the calculator may not be accurate. If that applies to you and you believe you qualify, please email financialaid@coloradocollege.edu

If a student qualifies for more financial aid than the Pledge provides, CC’s need-based financial aid program will meet their demonstrated financial need, ensuring families always receive the greater of the two awards. This means families can plan with confidence, knowing CC will be a comparable investment to other colleges in the area.

College Within Reach: Student Voices

Hear directly from some recipients of the Colorado Pledge:

Frequently Asked Questions

We encourage all Four Corners families seeking to verify their eligibility to complete the Net Price Calculator. Once you have received your calculation results, we encourage you to apply to CC and complete the full financial aid application.

While the Net Price Calculator will soon account for Four Corners Pledge in its estimates, estimates can be less accurate in situations where a family owns a small business or a farm, where parents are separated or divorced, or where a family's assets are not typical for their income level. We encourage those families to schedule a personal meeting with a member of our team.

"Typical assets" refers to what most families in your income range usually own — like checking and savings accounts, and modest investments.

Families with assets significantly beyond that norm — such as real estate beyond the family home, large investment portfolios, or extensive business holdings — may not qualify for the Four Corners Pledge. But even then, Colorado College remains committed to meeting 100% of demonstrated financial need.

Awesome! Outside scholarships reduce what your family must pay first. Your Four Corners Pledge grant funding won't change unless the total amount of aid-from any source-exceeds CC's total cost of attendance.

In those uncommon cases, we always start by reducing federal work-study or your student loan amounts.

We recognize families may have unique circumstances. The Net Price Calculator isn’t always accurate for families with divorced or separated parents. To get an estimate, each parent can complete the calculator separately, but your official eligibility will be determined once you submit the full financial aid application.

Both parents will need to provide information, but we keep each household’s details confidential. We’ll only share the overall eligibility with you, not one parent’s specific financial information with the other.

If you’re unsure about how to proceed, our team can walk you through what’s needed.

At CC, we always meet your family's full financial need. Here's how CC-funded merit scholarships fit in:

- If the merit scholarship is less than your demonstrated financial need: Your student still receives the full amount of aid needed. The merit award combines with need-based aid so the total stays the same — just made up of both types.

- If the merit scholarship is greater than or equal to your demonstrated financial need: Your student keeps the full merit scholarship. In this case, the need-based aid is reduced or replaced, since the scholarship itself covers your demonstrated need.

We use your family’s Adjusted Gross Income (AGI) from your federal tax return (line 11 on the 1040).

You'll reapply for aid each year. If your income or assets change, your aid may change too.

If your income or assets move outside Pledge ranges, you may no longer qualify for the Pledge, but CC will still meet 100% of your demonstrated financial need.

Absolutely! Our student financial services team is happy to answer questions.

We can be reached at financialaid@coloradocollege.edu; 719-389-6651 or toll free at 800-260-6458

We recommend completing the Net Price Calculator first to guide our conversation — but if your family’s situation is more complex, or you just want to talk through the program, reach out anytime.

show all / hide all